HDFC Home Loan, How to Apply, Processing Fees and Terms and conditions

About HDFC Home Loan

HDFC Home Loan, How to Apply, Processing Fees and Terms and conditions : HDFC is a private banking system which is working since August 1994. HDFC is the community which sells his different type polices in many sectors of HDFC Bank Limited is an Indian banking and financial services company, headquartered in Mumbai, Maharashtra. Besides it, HDFC Bank is India’s largest private sector bank by assets and by market capitalization as of April 2021. It is the third largest company by market capitalization on the Indian stock exchanges. The full name of HDFC bank is Housing Development Financing Corporation. In across the world HDFC bank work for different sectors.

To mitigate financial distress amid the second wave of covid pandemic, the State Bank of India (SBI) has recently unveiled a new personal loan plan — Kavach Personal Loan. Under this scheme, an individual can take loans starting from Rs 25,000 to up to Rs 5 lakh to “cover expenses of COVID-19 treatment of self and family members,” the lender said. The loan will collateral-free.

“With this strategic loan scheme, our aim is to provide access to monetary assistance – especially in this difficult situation for all those who unfortunately got affected by COVID. It’s our constant endeavor at SBI to work towards creating financial solutions for customers suiting their requirements,” said Dinesh Khara, chairman, SBI.

HDFC Home Loan Customer Care

HDFC bank cares his customers and so different type inquires and solutions are made by HDFC banks services. Here we are providing the list of customers care toll free numbers for HDFC loan. These are the official contact no. of HDFC bank. Toll free no. of HDFC Bank is 0141 6160616 with 24*7 services. So watch full detail of HDFC Bank official site.

| HDFC Bank Customer Care Phone Banking Numbers in India | |

|---|---|

| Ahmadabad | 079 61606161 |

| Mumbai | 022 61606161 |

| Pune | 020 61606161 |

HDFC Home Loan Interest Rate other charges

The loan under Kavach Personal Loan will have an interest rate of 8.5 per cent per annul. There will be no processing fee for availing loans. The bank has also waived-off the foreclosure charges and per-payment penalty for customers.

HDFC Home Loan Portal

- Step 1Visit the website of the online home loan provider – https://www.hdfc.com

- Step 2Click on ‘Apply for Home Loan’

- Step 3To find out the loan amount you are eligible for, click on ‘Check Eligibility’.

- Step 4Under the ‘Basic information’ tab, select the type of loan you are looking for (home loan, home improvement loan, plot loans, etc.). You can click on the link beside the loan type for more information.

- Step 5If you have shortlisted a property, click on ‘yes’ in the next question and provide the property details (state, city and estimated cost of property); if you haven’t yet decided on the property, select ‘no’. Fill in your name under ‘Applicant’s Name’. If you want to add a co-applicant to your loan application, select the number of co-applicants (you can have a maximum of 8 co-applicants).

HDFC Home Loan Eligibility

HDFC offers home loans to eligible customers at affordable interest rates starting at 6.90% p.a. The can be repaid over a period of 30 years. However, you will get a loan only if the bank deems you eligible. Your depends on various parameters, including your employment status, age, credit score, and monthly/annual income, to name a few. Depending on your eligibility, the bank will finalize your loan amount and approve your application.

| Age | 21 – 65 years |

| Employment Type | Salaried and Self-employed professional and non-professional |

| Minimum Salary for Salaried | Rs.10,000 per month |

| Minimum Salary for Non-Salaried | Rs.2 lakh per annul |

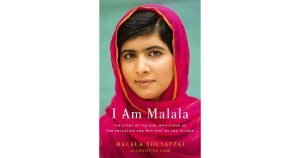

HDFC Home Loan for NRI

A co-applicant and GPA is compulsory for NRIs applying for home loan in India. A GPA holder either has to be a co-applicant or guarantor to the loan, with certain exceptions. The guarantor to the loan is a must when a local resident is not available as a co-applicant

HDFC Home Loan Prepayment

HDFC Bank allows you for the partial payment of a personal loan if you have taken HDFC Bank Personal Loan, on or after 1st of April 2018. The way part payment works is it knocks down the unpaid principal amount, which in turn reduces the EMIs and the total interest amount.

Disclaimer: All Images that are Used in this post from Instagram & Google Image and Credit Goes to their Respective Owner. Contact Us on this Email contact@thalabhula.com for Credit or Remove these Images.

- About HDFC Home Loan

- HDFC Home Loan

- HDFC Home Loan Eligibility

- HDFC Home Loan for NRI

- HDFC Home Loan Interest Rate other charges

- HDFC Home Loan Prepayment

- How to Apply

- Processing Fees and Terms and conditions

- Tenure and Loan Moratorium